Here is a comprehensive article on crypto, block rewards, stop orders, and perpetual futures:

“Navigating the Cryptocurrency Market: A Guide to Block Rewards, Stop Orders, and Perpetual Futures”

The world of cryptocurrency has come a long way since its inception in 2009. With the rise of decentralized finance (DeFi) and digital asset trading, investors have more options than ever to buy, sell, and trade cryptocurrencies. However, navigating this complex market can be difficult for beginners.

Block Reward: The Basics of Cryptocurrency

A block reward, also known as a transaction fee, is a key component of cryptocurrency transactions. It refers to the amount of cryptocurrency that miners are rewarded each time they solve a complex mathematical puzzle (called a “block”) on the blockchain. This block reward has increased over time, with some coins, such as Bitcoin, increasing by as much as 10% per year.

For example, Bitcoin’s block reward is currently 6.25 BTC per block, while Ethereum’s block reward is 12 ETH per block. The increased block reward incentivizes miners to continue validating transactions and maintaining the security of the blockchain.

Stop Orders: An Effective Trading Tool

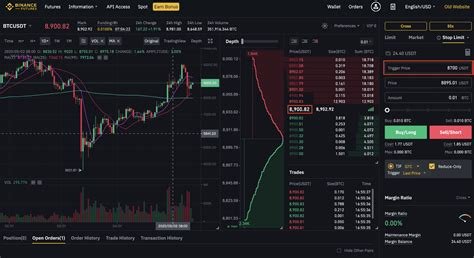

A stop order is a type of order that specifies a specific price at which a trade should be executed if the market moves in a certain direction without reaching that level. In cryptocurrency trading, stop orders are used to limit potential losses by locking in profits when the price reaches a certain point.

For example, a trader might place a stop order to sell Bitcoin for $50,000 with a 1% profit target. If the price falls to $45,000, the stop order will automatically be executed, buying back the asset at the current market price. This is known as a “stop-loss” trade, and it can help traders avoid significant losses if their trade doesn’t perform as expected.

Perpetual Futures: A Compound Derivative

Perpetual futures are derivative instruments that allow investors to take positions in cryptocurrencies without having to worry about fluctuations in the price of the underlying asset. These instruments work by creating a permanent contract between two parties, in which both parties agree to buy or sell a certain amount of cryptocurrency at a fixed price (called the “spot rate”).

For example, a trader might enter into a perpetual futures contract for 1 million units of Bitcoin, which means they are obligated to buy or sell 1 million units of Bitcoin at a spot price of $50,000. If the market reaches a new high of $55,000, the trader can close out their position and make a profit.

Navigating the Cryptocurrency Market

To succeed in the cryptocurrency market, traders need to understand the basics of block rewards, stop orders, and perpetual futures. By understanding these concepts, investors can make informed decisions and navigate the complex world of cryptocurrency trading.

Here are some tips for navigating the crypto market:

- Stay informed: Stay up-to-date with market news and analysis from trusted sources.

- Use stop-loss strategies: Lock in profits to avoid significant losses when the market moves against you.

- Diversify your portfolio: Spread your investments across different cryptocurrencies to minimize risk.

- Educate yourself

: Continually learn new concepts, tools, and strategies to improve your trading skills.

In summary, the cryptocurrency market is a complex and rapidly evolving field. By understanding block rewards, stop orders, and perpetual futures, traders can make informed decisions and navigate the market with confidence. Don’t forget to educate yourself, use stop-loss strategies, diversify your portfolio, and stay informed about the latest trends and tools.

Leave a Reply